Here is our comprehensive guide on how to write an invoice that will help you create professional invoices and get paid faster. In this guide, we will cover everything from what an invoice is and why it's important, to the different types of invoices, what information to include, and how to send and follow up on invoices.

What is an Invoice and Why is it Important?

An invoice is a document that itemizes and records a transaction between a buyer and a seller. It serves as a request for payment from the buyer to the seller, detailing the goods or services provided and the amount due.

Invoices serve as a request for payment, detailing the goods or services provided. They come in various forms, including standard, proforma, and recurring invoices, each serving different purposes. Understanding these distinctions is key to selecting the right invoice type for your transactions.

Invoices are important for several reasons. First, they provide a clear record of the transaction, including the terms and conditions agreed upon by both parties. They also serve as a legal document that can be used to enforce payment if necessary. Additionally, invoices help to establish a professional image and build trust with clients, which can lead to repeat business and referrals.

Types of Invoices

There are several types of invoices that you may encounter, depending on the nature of your business and your invoicing process. Here are some of the most common types of invoices:

- Standard Invoice: This is the most common type of invoice, which simply lists the goods or services provided, along with the quantity and price.

- Proforma Invoice: This is a preliminary invoice that is issued before the goods or services are provided. It provides an estimate of the total cost and is often used for customs purposes.

- Commercial Invoice: This is a document that is required for international trade, providing details of the transaction, including the type and quantity of goods, the price, and the terms of payment.

- Time-Based Invoice: This type of invoice is used for services that are provided over a period of time, such as consulting or freelance work. It itemizes the hours worked and the hourly rate, and may include additional expenses such as travel or materials.

What Information to Include on an Invoice

Timeliness and clarity are paramount in invoicing. Send invoices promptly and craft them to be easily understood. A professional appearance can also enhance the credibility of your business.

Avoid common pitfalls such as inaccuracies, late invoicing, and neglecting to follow up on unpaid invoices. These mistakes can lead to disputes and cash flow issues.

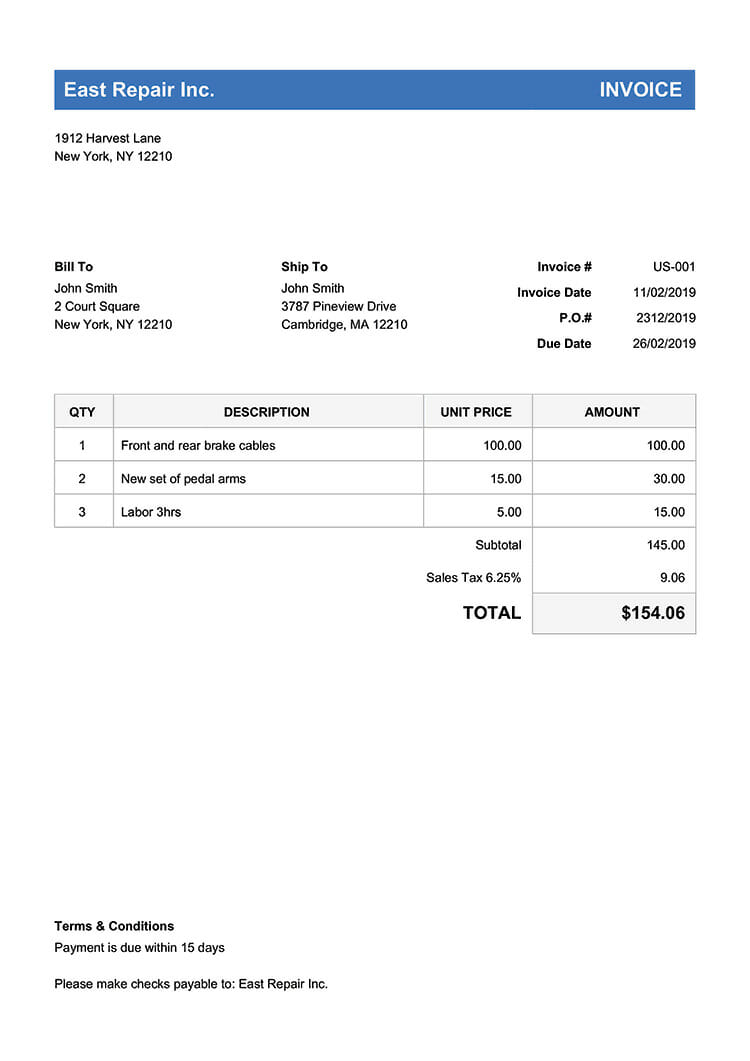

To ensure that your invoice is clear, accurate, and professional, it should include the following information:

- Invoice Number: This is a unique identifier that is used to track the invoice and ensure that it is paid in a timely manner.

- Date: This is the date on which the invoice is issued.

- Company Information: This includes the name and address of both the buyer and the seller.

- Description of Goods or Services: This should be a detailed description of the goods or services provided, including the quantity and price. Learn how to price your services depending on your industry in addition to understanding billable hours.

- Payment Terms: This should include the payment due date, any late fees or penalties, and any accepted payment methods.

- Total Amount Due: This is the total amount that is owed by the buyer.

How do I Invoice Someone and Follow Up

Once you have created your invoice, you will need to send it to the buyer and follow up to ensure that it is paid on time. Here are some tips for sending and following up on invoices:

- Send the invoice promptly after the products or services have been provided.

- Use a professional tone and format, and ensure that all information is accurate and complete.

- Follow up with the buyer a few days before the payment due date to remind them of the upcoming payment.

- If the payment is late, follow up with a polite but firm reminder, and consider adding late fees or penalties as specified in the payment terms.

- Try using field service invoicing software to automate the process on how to write an invoice and sending.

Be Clear and Concise

Your invoice should be clear, concise, and easy to read. When learning how to write an invoice, practice avoiding using jargon or technical terms that the buyer may not understand. Use simple language to describe the goods or services provided. Use bullet points or numbered lists to break up long paragraphs and make the invoice easier to scan.

Use a Professional Invoice Template

Using a professional invoice can help you to create a consistent, polished look for your invoices. Many accounting software programs offer free invoice templates that you can customize with your own logo and branding. Alternatively, you can create your own using a word processing program like Microsoft Word.

Include Contact Information

Make sure to include your contact details on the invoice, including your name, phone number, and email address. This will make it easier for the buyer to contact you if they have any questions or concerns about the invoice.

Specify Payment Terms

Your invoice should clearly specify the payment terms, including the due date and any late fees or penalties. You should also include accepted payment methods, such as credit card, check, or online payment platforms like PayPal.

Follow Up Promptly

If the buyer does not pay the invoice on time, it's important to follow up promptly to avoid any further delays. Send a polite but firm reminder and consider offering a payment plan or alternative payment options if the buyer is experiencing financial difficulties.

Conclusion

Writing a professional invoice is an essential part of running a successful business. Use these tips to make clear, short, and professional invoices. This will help you to get paid on time and maintain a good relationship with clients. As a business owner, always be polite, helpful, and attentive to your clients to make your business successful.

Invoicing is crucial for business as it affects cash flow, customer relationships, and legal compliance, not just sending bills. By using good methods and technology, you can make invoices that help get payments on time and help your business succeed.